By Tasha Wibawa, 360info in Melbourne

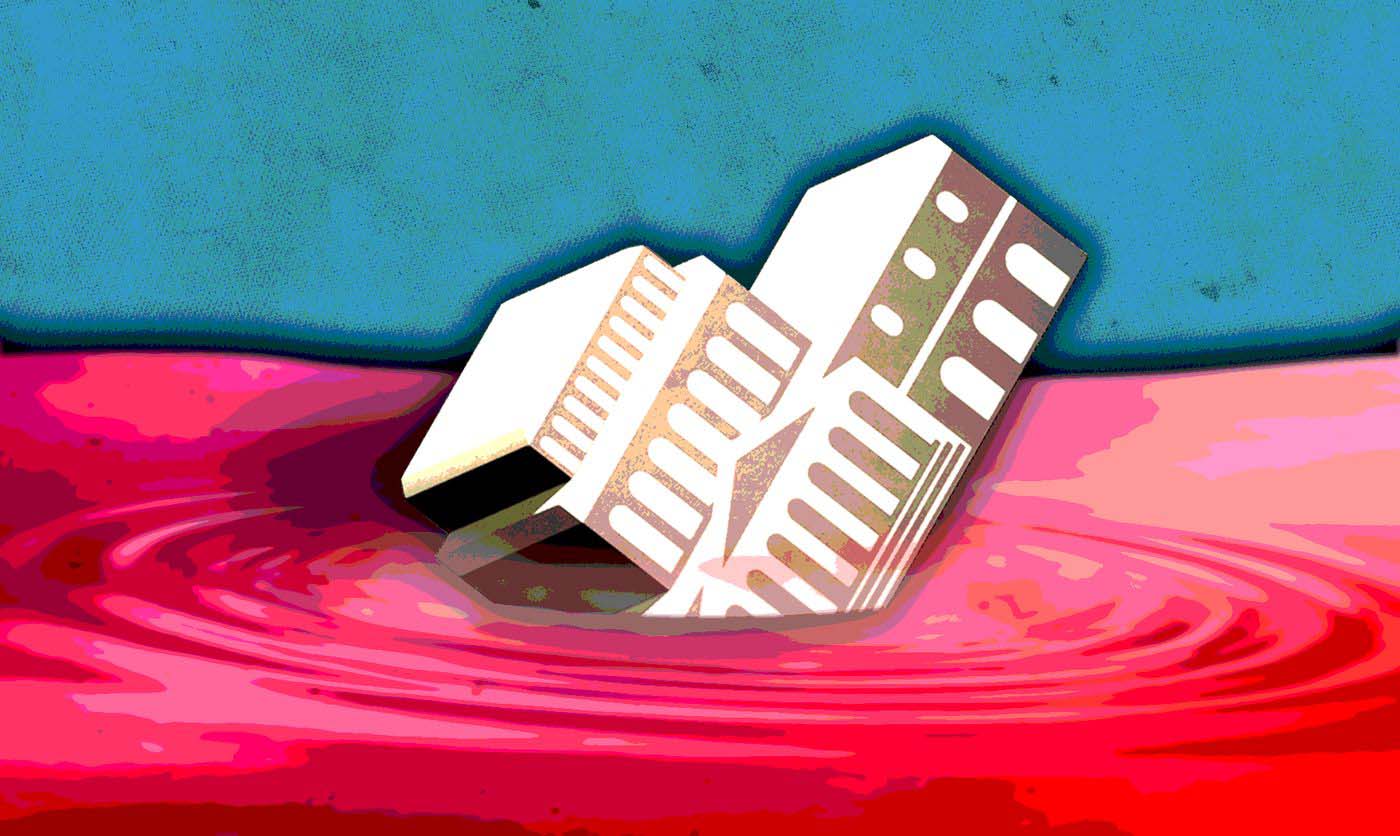

Government debt in developing economies has reached a record high of USD$98 trillion.

This is despite total global debt declining for the first time since 2015, driven directly by developed economies, according to a new report by the Institute of International Finance published on Wednesday.

“The external public debt burden of many developing countries worsened due to sharp losses in local currencies (in 2022) against the [US] dollar,” the IIF told Reuters, adding that there is “no sign of imminent recovery”.

Developing economies yet to recover from the COVID-19 pandemic are facing high-interest rates and a strong US dollar, making it more expensive to service their debt at a time when the price of food and energy is also growing.

Pakistan is one of those nations feeling the pinch. On the brink of a debt default, its Defence Minister, Khawaja Asif, said the country has gone “bankrupt”.

Prime Minister Shehbaz Sharif announced cost-cutting measures including banning ministers from flying business class or staying in five-star hotels.

“It has also been decided to withdraw luxury vehicles from ministers … they will be auctioned where necessary,” the PM said on Wednesday.

But short-term measures will only divert the current “fiasco”, according to Pakistani economists Wajid Islam from the Khyber Pakhtunkhwa Technical Education and Vocational Training Authority and Junaid Ahmed, from Westminster International University.

“Stringent long-term structural reforms are what Pakistan needs to stay afloat,” they said.

“The government has to grow its surplus by controlling expenditure, which is possible by introducing competitiveness, reforming the tax system, diversifying its export base, reducing the trade deficit and providing a suitable environment for investors, which will reduce the budget deficits and dependency on handouts.”

Government debt itself isn’t the problem, a degree of it is healthy for economic growth.

“More important than the raw magnitude of debt is its level relative to the size of the economy, as this ratio indicates a country’s ability to service its debt,” said Gigi Foster, economics professor at UNSW.

Countries unable to pay back or restructure their debts — often due to poor historical monetary policies — can result in economic collapse and political turmoil, largely seen in Sri Lanka in mid-last year.

Umesh Moramudali, lecturer at the University of Colombo, said Sri Lanka has made some progress with debt restructuring and private bondholders have shown a willingness to restructure debt.

“The lesson Sri Lanka teaches is that middle-income transitions sound and look fancy for many low-income countries. But hurrying into it without fixing structural issues in the economy, strengthening institutions and ensuring strong checks and balances can create economic catastrophe,” he said.

Developed countries like the United States and Japan also face debt difficulties this year.

Japan currently has the most government debt of any country, estimated at 263 percent of the size of its economy and double the ratio of the US.

“The government and the central bank are trapped in a vicious cycle of excessive debt burden,” said Toshiro Nishizawa, professor at the University of Tokyo.

In January, the central bank decided to maintain its policy to purchase bonds without setting an upper limit and allowed ten-year bond yields to remain at around zero percent.

“Economics tells us that Japan cannot keep interest rates low, maintain a stable currency and keep up free capital flows simultaneously. The theory is called the impossible trinity,” Professor Nishizawa said.

“A weaker yen implies the products and services offered by Japanese labour are at bargain prices while households face import-induced price hikes.”

He adds that the “growing mountain of public debt” will fall on the next generation if left unchecked.

Last month, the US hit its USD$31.4 trillion debt ceiling — a limit on the amount of money the government can borrow.

It’s now up to Congress to decide whether to lift the debt limit, or risk a default sometime between July and September, according to a forecast issued last week by the Congressional Budget Office.

Government debt and politics tend to go hand in hand. They may seem like issues far bigger than us, but in a democracy you may have a bigger role to play than you think.

“The person on the street is often a government creditor. If you have a retirement fund, chances are a government somewhere (maybe even your own!) owes you something,” said Professor Foster.

“You have the power to stop lending to it by altering your investment mix – and together with the choices of many others, this can matter.

“People often feel they are powerless in the face of high finance organised by the well-connected elite classes … [yet] regular people still hold the power to put their money, their voice and their vote behind more sensible spending programmes and more accountable leadership for their country.”

Originally published under Creative Commons by 360info™.