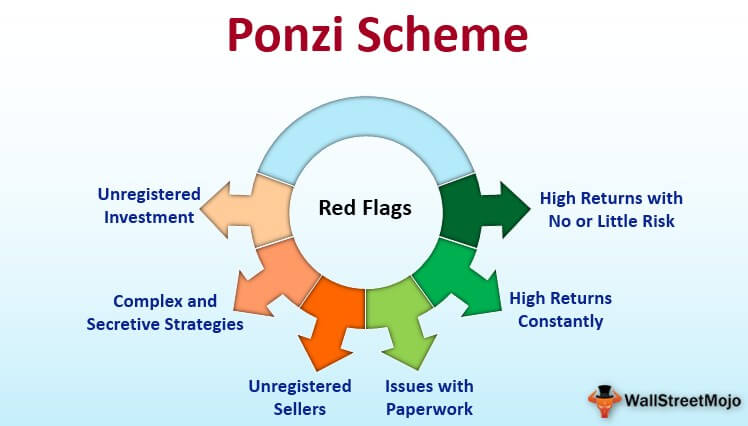

Ponzi schemes are fraudulent investing scams, promising high rates of return, at little risk to investors, which can never happen in a long-term basis. Almost all investors fall for the initial temptation of high interest promise of Ponzi schemes. “Its human nature,” says Susan Grant of the National Consumers League. “The crooks know that there are basic human factors that they can appeal to – the desire to do what you think you see other people doing around you, making money and getting rich.”

Typically, a Ponzi scheme generates returns for early investors by acquiring new investors. The funds obtained from the new investors are used to pay the old ones, so that it forms a pyramid structure. For instance, if a promoter of the scheme takes Rs. 1000 each in the first month from the first two investors, having pocketed the Rs. 2000, he now needs Rs. 4000 from four new investors in the second month to pay the first two investors what is due to them. In this way, in the third month he needs Rs. 8000, for which he needs to find eight new investors. Again, in the fourth month, he will need to find sixteen investors,and going in this way, in the 10th month the number of investors will be 1024, which in the eighteenth round will come up to more than 2,50,000 investors. The scale of the fraud can be measured from this fact, because the principle of the Ponzi scheme is to rob Peter to pay Paul. But the scheme is destined to end up in what is called a ‘collapse’ because the earnings, if any, are less than the payments to investors.

The Ponzi scheme is named after a notorious swindler in the US in the 1920’s, Charles Ponzi, who started the fraudulent investments operations. Ponzi became notorious using the technique of enticing new investors by offering returns other investments could not at that time, in the form of short-term returns with abnormally high or unusually consistent returns. Ponzi was an Italian con artist who used to operate in the US and Canada. He was born and raised in Italy and first became known in North America for his money making scheme.

The catch here is that investors believe that the returns are coming from product sales or other means, while they do not know that other investors are providing the funds to keep the scheme going. This idea of running a swindling scheme had already been carried out from 1869 to 1872 by Adele Spitzeder in Germany and by Sarah Howe in the United States in the 1880’s through what was known as the ‘ladies deposit’. Howe offered a female only clientele an eight per cent monthly interest rate, and then stole the money that the women had invested. Her fraud was eventually discovered and she was sent to prison for three years.

Ponzi himself was probably inspired by the remarkable success of William “520 per cent” Miller, a young Brooklyn bookkeeper who in 1899 fleeced gullible investors to the tune of more than one million dollars. The Ponzi scheme, it would be interesting to know, was described in Charles Dickens’ novels Martin Chuzzlewit and Little Dorrit. Ponzi gathered 15 million dollars in just eight months in Boston by promising the Bostonians that he had discovered the secret to wealth. So famous had his scheme become that he was in the headlines of the Boston Post newspaper in 1920 that introduced him as a sort of wizard who could double your money in just three months with 50 per cent interest paid in 45 days. His worth it was said was 8.5 million dollars at that time. However, he was also arrested and jailed several times for forgery. He was deported finally as an unwanted alien to Italy, and later, died in penury in 1949 in a Rio de Janeiro charity hospital, leaving 75 dollars to pay for his burial.

According to informed sources, why a Ponzi scheme fails for the promoter is related to certain factors. The foremost is that as more investors become involved the likelihood of the scheme coming to the attention of authorities increases. Secondly, the promoter vanishes taking all the investment money when the accumulation of money is high for him. The other factor is that the scheme collapses under its own weight as investments slow down and the promoter is unable to pay out the promised returns. Another factor is the external market forces, like a sharp decline in the economy, which causes many of the investors to withdraw a part of, or all their funds, due to natural market fundamentals that accompany the economy.