How do we look at the newly announced budget for the financial year 2021-22 when, since the beginning of the past year nothing seems to have gone right for anyone due to the pandemic, subsequent economic recession and a need to maybe take on China after the winters are over, the way the recalcitrant neighbouring country is taking things for granted with India. So let’s take the requirements of the budget in one broad sweep since money has to be in the right hands and the economy required to grow back to earlier 2019 levels as soon as possible. Did the government do much to address issues of importance and can we keep our hopes high for a better future ahead? Let’s try to know since for all the political hype budgets normally are not very kind on the lengths and breadths of poverty India is associated with. How do these scenarios of penury register with the idea of political and economic ambitions? Or to put in simple words, is welfare a tangible occupation with politicians, or have we surpassed that concept, and now are into more of an idea of a purely tech savvy nation which has already had a disconnect with the idea of democracy as a welfare state.

Basically, how far is the new budget at a tangent from the nation’s real requirements? And let’s take up the first statistics – that around 80% is the same suffering India, what it was, before the 20% of the rest somehow thought it wasn’t any more, as everyone had a mobile phone in his hands and could ‘connect’ with their families though they are living under the same roof. And one massive change is that the family has come a far distance from each other where everything Indian like our food, clothing and shelter are abstractions from our earlier selves. Though nothing’s wrong with owning a mobile or being tech savvy, but just that the benchmark has changed too soon and is almost manic, and that with less food in the stomachs of many is quite tragic and unpalatable. Something you wouldn’t know unless you have to step out of your car and walk a distance on the road, which is your land you own as a citizen of this country. The tempting glare of the present is offering hues to our lived past, but we never lived in the shade that is being attributed to us. Even the sun is over the smog in New Delhi, an important city, and one cannot say if that is God-given, and thus not accountable in the economy or the budget of this day as a liability.

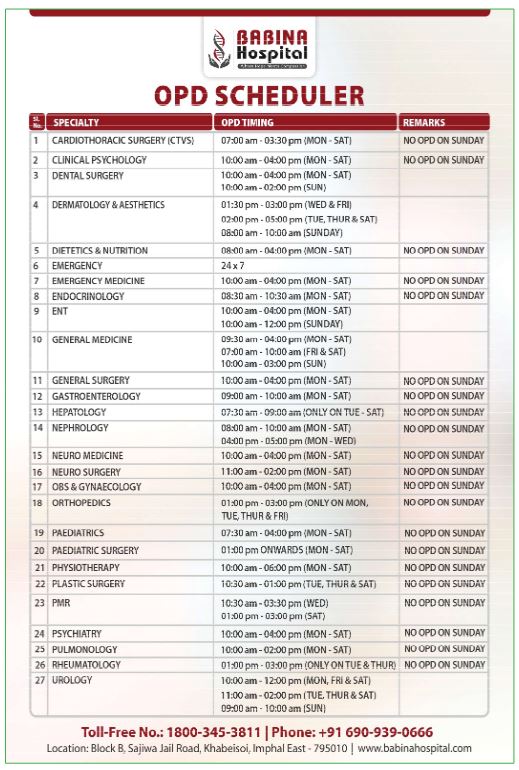

The economy is projected to contract 7.7% in the current financial year, but experts have said the contraction would actually be more since data for the unorganised sector is not available and 200 million daily wage earners lost jobs. And even those who had salaried jobs, 20% have still not got back their jobs. The service sector like travel, tourism, hotels and restaurants are still down and not been able to revive. After hanging on throughout since the beginning of the pandemic period a busy upmarket restaurant in Gandhi Avenue just this week put out notice it is shutting down as it has reached the limits of its losses. A lot of the blame goes to the government for such impending business shutdowns even in these, hopefully, culminating stages of the pandemic, as the government failed to boost consumption by making expenditures on the poor. There’s hardly any purchasing power pumped in for the demand to go up. Unless the government provided jobs and made purposeful spending how could the economy find growth. Components where you give purchasing power to the poor through Rural Employment Guarantee Scheme and PM Kisan Scheme have been curtailed for no valid reasons.

The textile sector which was once thriving has been charged a not so much required Custom duty of 10% on cotton imports. No thought seems to have been given to these matters. Even the textile industry group has asked for a withdrawal of this import duty on cotton. Instead of reviving the textile industry through injecting more imaginative ideas for it, the budget has not taken into consideration the fact that India has a pile of cotton in surplus and the labour intensive cotton textile industry could have been targeted for growth and employment induction. Indian cotton is at the highest in the last five years and has seen an increase of 14% over the previous year. There is higher global production and lower consumption with exports surging globally. How could a push in curbing imports be useful when cotton textile productions failed in India, and with exports of cotton anticipated to surge to 44.50 million bales in 2020-21 worldwide? Why put a cap when there’s a heavy surplus of cotton that could be exported to countries like Bangladesh and Vietnam who are importing heavily to meet demands, and which would also work as a proposal to bolster other trade.

Cotton production has come down in the US, Brazil, Pakistan, Turkey, and what’s the standard of exchange being set by India with the Customs surcharge. How can you protect a produce that’s in surplus and also has no large domestic consumption. To show some calculations here, 1 kg of cotton can produce 5-6 T-shirts costing around Rs. 300 each. In November 2020 the Ministry of Agriculture said the country had 322 lakh bales of cotton costing Rs. 127 per kilo which amounts to around Rs. 700 crores. Now in the form of readymade T-shirts the revenue would be Rs. 2,09,622 crores when sold as the cheapest priced T-shirts. Why then is the budget not investing in reviving the cotton textile industry in India? Why are giant silos more important than the cotton textile industry while evaluating the economy? We shouldn’t be looking to starve trademark Indian industries like cotton textiles while promoting inhumane corporatisation.

Then there are other factors like increasing duties on solar inverters from 5% to 20% and solar lanterns from 5% to 15% as if we are selling in a toy of an economy. Again tunnel boring machines have invited only 7% Customs charge and this benefits only companies selling these to India. And why drill through 100s of mountains. Can’t you just travel on a longer mountain way. That’s what mountains are for and made naturally distant and hard to access as it’s full of resources which are good when kept intact for the world’s environmental safety. You can’t strip the mountains bare. And to drill through the mountains and talk at the same time of Hindutva, if that term somehow denotes preserving Indian remote cultures and mindsets, which are so much part of the mountains especially, in India.

The Agriculture Infrastructure Development Cess (AIDC) proposed on petrol and diesel by a considerable amount of Rs. 2.5 per litre on petrol and Rs. 4 per litre on diesel again shows that the government is intent on needlessly devising ways to turn the heat on the traditional time tested agricultural marketing structure of India, and is in favour of creating infrastructure for corporatisation. This at a time when the government is also calculating how their idea of Hindutva can be summarised in multi-crore spending in various projects. Not really acceptable that politics should be mixed with religious ambitions in a purely secular Constitution we have in the Republic. And what happens to the rest of the important welfare, business and administration left for it to carry out.

To take up one more category, the government claimed banking has seen remarkable success, but Rs. 20,000 crore of taxpayers’ money has been used in the recapitalising and reviving of bad Public Sector Banks (PSBs). Experts say, without private participation in the existing PSB governance structure there will be bad banks just to write off bad debts. Already according to the Reserve Bank of India just frauds in the banking system amounted to over Rs. 77,000 crore the previous year and Rs. 1.85 lakh crore in the subsequent year. Experts also say that this anomaly can be seen in the way corporates get away after squeezing dry banks and just walking off without any censorship. So a lot of things are happening in the finance sector. Even the common Employees Provident Fund for workers is actually run like a money market by the government where the employee’s contribution is used by the government to generate money till a time the government’s share is to be paid to the employee. It’s not really a social security scheme in the classical sense.

Let’s take up another last point, that of the health budget. The Finance Minister Nirmala Sitharaman has announced the ‘PM Atmanirbhar Swasth Bharat Yojana’ at an outlay of Rs. 64,180 crores over the next 6 years. But like all the other announcements of chunks of money for supplying the budget, it’s not clear when and how these budgetary allocations are put in public use at ground level. These are just numbers and paperwork that no one really comes to know how it reaches the people, or does it at all.

There’s no water in India, people are not bathing, malnutrition is rampant, women are facing problems of empowerment and gender issues, roads are made only for vehicle owners, not pedestrians who are not counted as users of the road who require pavements though they are taxed for roads built. Medicines and treatment are unaffordable, clothes are low quality and uncomfortable, food is simply not a local taste. One wonders what will be left of us by the time we reach the much too soon celebrated 5 trillion dollar economy. We must remember Hindutva was just an electioneering plank, it’s nothing to do with our long term economic sustenance. The budget each year as of now is not serving the poor masses of India who till now seem to be spellbound by Hindutva, but these same masses do think of elections also as much as any political party does. One only hopes we do not fail each other as we had started the discussion with the impending situation in mind of the pandemic and the war with China most importantly.