Manipur Deputy Chief Minister Yumnam Joykumar who is also in charge of Finance, on the third day of the 12th Session of the 11th Manipur Legislative Assembly, on February 5 presented the 5th and last Budget Estimates of the Government of Manipur for the financial year 2021-22.

According to the Budget Estimates presented, the total receipt for the financial year 2021-22 is estimated at Rs. 26,024 crore from revenue receipts and capital receipts of Rs. 21,520 crore and Rs. 4,504 crore respectively. Total estimates of State’s own tax and non-tax receipts assumed in the Budget Estimates 2021-2022 is Rs. 2,055 crore and Rs. 388 crore respectively while the receipt from the State’s share in Central Taxes & Duties is estimated at Rs. 4,765 crore.

A total expenditure of Rs. 28,824 crore is proposed for the year 2021-22 out of the Consolidated Fund of the State. Total Revenue Expenditure is estimated at Rs. 19,970 crores while Capital outlay is estimated at Rs. 5,526 crore.

The Budget Estimate of Rs. 28,824 crore for the financial year 2021-22 has skyrocketed from the Budget Estimate of Rs. 20,870 crore for 2020-21 while the Revised Estimate for the financial year 2020-21 has been calculated at Rs. 24,986 crore.

Hence, the Budget Estimate of Rs. 28,824 crore for 2021-22 is Rs. 7,954 crore higher than the Budget Estimate of the financial year 2020-21 which was Rs. 20,870 crore and still Rs. 3,838 Crore higher than the Revised Estimate of Rs. 24,986 crore for 2020-21.

It may be recalled, in the Budget Estimates for 2020-21 the revenue receipts and capital receipts were estimated at Rs. 18,083 crore and Rs. 2,063 crore respectively. In Revised Estimate for 2020-21 this has now been calculated at Rs.17,517 crore and Rs. 4,853 crore respectively.

The Finance Minister said the Capital outlay has increased significantly from the Budget Estimates of Rs. 3,356 crore to Rs. 4,541 crore in the Revised Estimates. All overall receipts and expenditure figures are inclusive of Ways and Means Advances and Repayments.

Taking into account all receipts and expenditures, the current year is expected to have a budgetary deficit of Rs. 2,616 crore in Revised Estimate for 2020-21 as against the deficit of Rs. 723 crore in Budget Estimate for 2020-21. The fiscal deficit for 2020-21 at Revised Estimate is projected at Rs. 3,743 crore, which is 9.93% of GSDP.

However, fiscal deficit for 2021-22 is estimated at Rs. 3,976 crore with 9.22% of the Gross State Domestic Product (GSDP) and the total outstanding debt projected at 32% of the GSDP during 2021-22 against revised estimate of 33%.

This tries to impress that the fiscal deficit is less than the fiscal deficit of 9.5% of the Union Budget and one percent less from the revised estimate of the State.

The GSDP for 2020-21 is estimated at Rs. 37,682 crore at current prices. In the next financial year 2021-22, the estimated GSDP at the current prices would have reached the level of Rs. 43,121 crore.

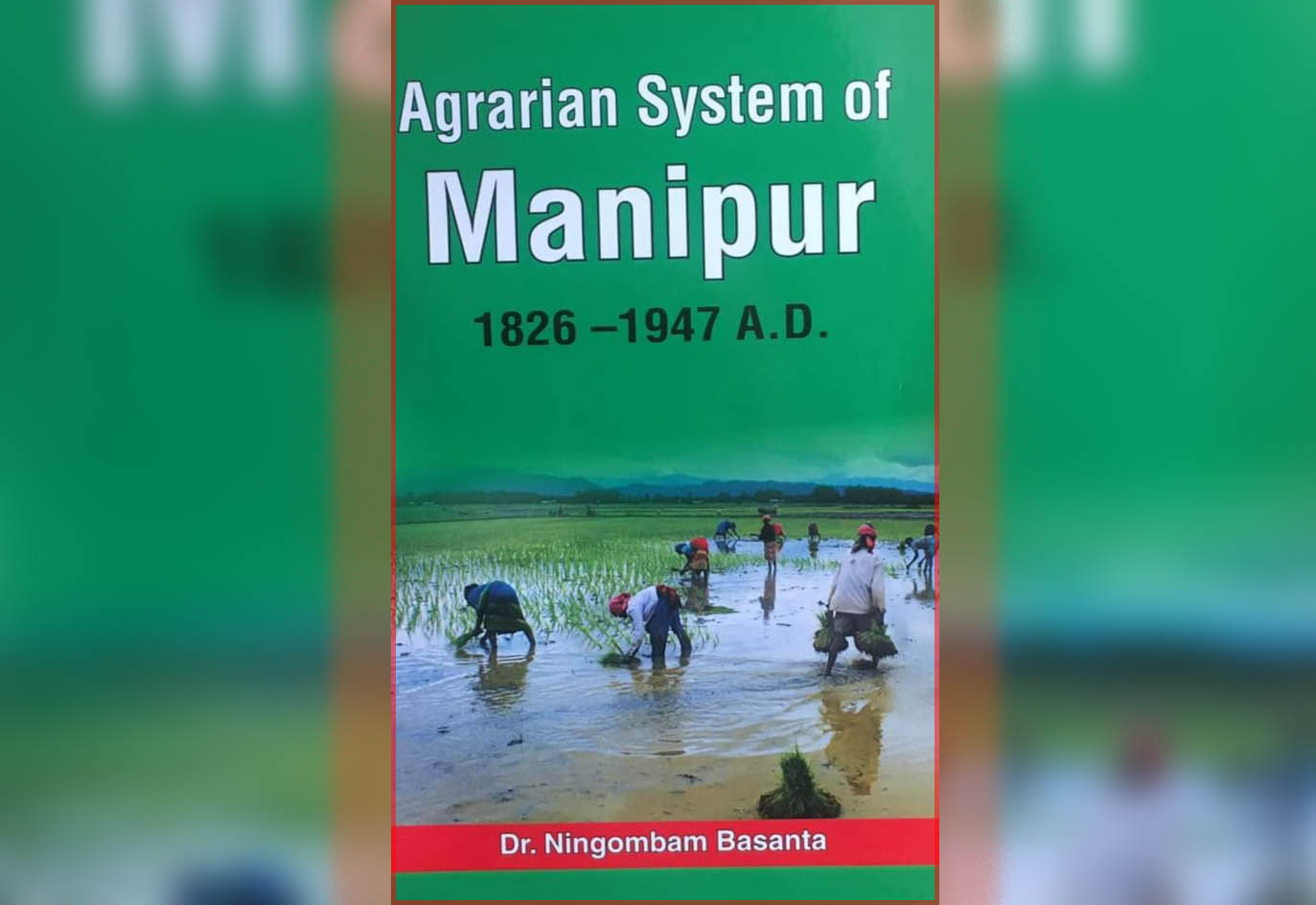

This also again tries to impress that there will be a better growth rate of the State in the coming financial year while the State’s economy is not yet recovered from the lockdown of COVID-19 pandemic. The Khwairamband Nupi Keithel, the heart of Manipur’s economy, is not yet opened till date.

Meanwhile the Finance Minister giving the Budget speech placed in the House some of the recommendations of the 15th Finance Commission for the period 2021-26.

For 2021-22, the Commission has assessed Rs. 4,716 crore as tax devolution for the State. Against this, the Govt. of India in its Budget 2021-22 has made provisions for Rs. 4,765 crore as State’s share in Central Taxes for 2021-22.

The Commission has recommended revenue deficit grant of Rs. 2,524 crore for Manipur for 2021-22. There is a substantial reduction in revenue deficit grant from the 2020-21 figures of Rs. 2,824.

The 15th Finance Commission has recommended grants for Zilla Parishads, Gram Panchayats, Autonomous District Councils and the Urban Local Bodies and an amount of Rs. 195 crore is recommended for 2021-22. Additional amount of Rs. 44 crore is earmarked as Health Sector Grants through local Governments and this amount shall be used for strengthening health infrastructure at rural and urban local bodies’ level. Out of Rs. 195 crore, 60% of the Grant shall be tied whereas 40% of the Grant shall be untied.

Yumnam Joykumar Singh also informed the House that the 15th Finance Commission in its report for the period 2021-22 to 2025-26 has prescribed certain entry level conditions for availing Local Bodies Grants. For the Rural Local Bodies level, the Commission has recommended online availability of both provisional accounts of the previous year and audited accounts of the year before as the entry level condition to avail of the grants.

The Commission has also laid down entry level conditions for availing grants for Urban Local Bodies as well. Urban Local Bodies have to mandatorily prepare and make available online in the public domain annual accounts of the previous year and the duly audited accounts of the year before previous. Further, States have to appropriately notify floor rates of Property Tax and thereafter show consistent improvement in collection in tandem with growth rate of State’s own GSDP.

Moreover, the Finance Minister stated that the last five years of the Government has seen the State move forward on all fronts and sectors. The actions and achievements have been duly recognised in various forums. Handling of the COVID-19 pandemic and management of the economy and public finances during this dire time have reaffirmed the trust of the people in the present Government. The Government will continue to work tirelessly for the people of the State and this Budget is proof of this commitment. It is not miracles but hard work, cooperation, grit and the blessing of the people that has enabled the Government to make many achievements in a short span of four years. It is a strong belief of the Government that the people will continue to put their trust in the Government and allow it to serve for many more years to come.

Meanwhile the presentation of Gender Budget Statement for the first time in the history of Manipur is notable in spite of its failure to have separate budgets for women as done in other states of India like Kerala.

The Budget shows the intention of the government to take up or continue many projects or welfare schemes for the State, like ‘Chief Minsiter gi Hakshelgi Tengbang (CMHT)’ improvement of infrastructures of health, ‘School Fagathansi’ under ‘Go to School Mission’ under the heading ‘Investing in Our Future, Drinking Water and Sanitation’ including early completion of ‘Chingkhei Ching Water Reservoir’, ‘Imphal Sewerage Projects’ and ‘Jal Jeevan Mission’; Information Technology, Connectivity, Go to Hills, Rural Development including Doubling the Farmers Income, Tourism, Arts and Culture and Sports etc.

Despite promises and hikes in the budget estimates, lack of budgetary allocations in the areas which are vital to bring incremental change is evident and the Manipur State Budget for 2021-22 still appears not to be a pro common people budget.

However, without deeper critical analysis, considering only the estimated total receipt of Rs. 26,024 for the financial year 2021-22 and the ground realities Manipur has been facing, the Manipur State Budget of total expenditure of Rs. 28,824 crore for 2021-22 appears to be too ambitious when the next Assembly Election is knocking at the door.