“I’m a non-salaried person, freelancing my service to make ends meet in a consumption driven economy where industrialization is yet to take off and the job market whirling in deep crisis. Faced with an unreliable monthly income coupled with the responsibility to take care of the monthly family expenses such as feeding and educating the kids and other essential expenditures, how would I react when a well-meaning friend, a successful businessman, make a suggestion to invest a saving and earn a monthly income of 3 percent? Even though the risk involved in stepping into a Ponzi scheme, played at the back of my mind, the immediate monthly financial compulsions made me brush aside the inherent exposure and I ended up taking the plunge. For at least one and half year, life was easy sailing and it was as if I’ve made a wised decision thanks to my friend. Then suddenly out of the blue, my ‘monthly income’ which I had kind of taken for granted, stopped coming, throwing me into a nightmarish financial crisis. I was failing to make my EMI obligations with the banks, family recreations had to be curtailed and I landed myself in huge debts,” narrated a visibly shaken investor of a private financial institute, fondly referred to as ‘bank’, when the said bank closed its door on its investors and stopped paying the committed monthly 3 percent interest rate on investment and even refused withdrawal of the capital invested.

The case of Mr. Z who refused to be identified, is not an isolated one. Similar or even sadder narratives of finance related family breakdown are abundant in Manipur state, characterized by low per capita income, poor financial literary and heavy reliance on non-banking transactions such as chit-funds, micro finance, pyramid marketing as way of savings and earning quick bucks.

Although the Saradha Group financial scandal and the Rose Valley scam that rocked West Bengal and Assam exposed the Ponzi operation of these private financial companies the northeast region isn’t totally free from its tentacles.

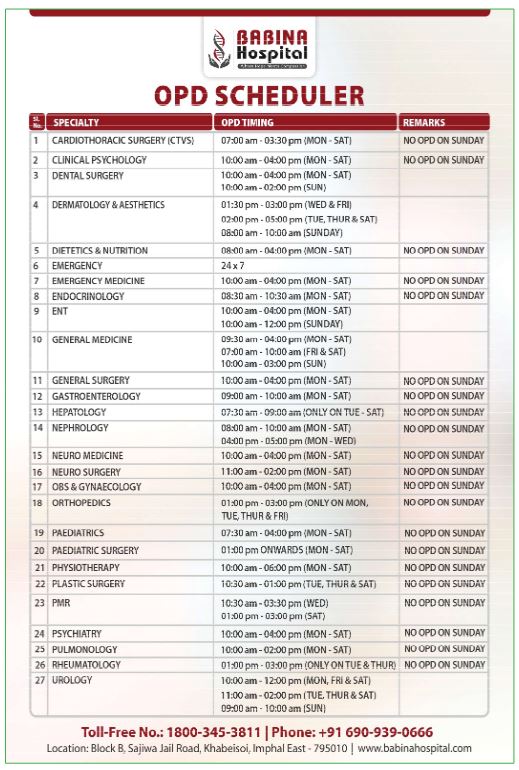

In Manipur, there are about a hundred private financial institutes operating mostly unregulated, still running their businesses on the principles of micro finance and offering monthly return on investment at a varying interest rate of 2 percent to 3 percent per month. The fear is that the gullible public of Manipur, especially from the lower middle class strata, despite having suffered huge financial losses on their investments on Pyramid marketing and similar schemes, the burning desire of financializing their hard earned savings at an attractive interest rate are likely to be duped by unscrupulous private financial institutions if the law enforcing agencies of the state continue to remain aloof.

The case of the ongoing plights of about 15,000 investors or promoters of the Smart Society, a registered cooperative society of the SALAI Holdings Private Limited is of particular interest. Under the SMART Society banner the Salai Holdings groups of Companies had offered 3 percent return of investment from what they refer to as individual ‘promoters’.

According to the Salai Holdings sources, this operation started as far back as 2008 in the form of ‘farmer’s clubs’ which the Salai Holdings had facilitated to assist farmers of the state with linkages to welfare programmes offered by the government. In 2010, when Manipur had experienced a bumper mustard seed crops, Salai Holdings had offered to buy back the surplus seeds from the ‘farmer’s clubs’ on credit which they paid back over a period of time. This experiment was a huge success for both parties. While the farmers got their desired price of Rs 1,200- per metric tonne (MT) for the mustard seeds as against the Rs 600/- per MT offered by the Agriculture department of the government of Manipur, for the Salai Holdings company, they successfully ventured into eatable oil refinery with the mustard seeds, selling like hot cakes with very good return.

From what started with few thousands of rupees grew to crores of rupees. While Salai Holdings officials declined to give a figure to number of promoters who are investing in the company’s varied activities and an accumulative amount of the value of investment from the promoters, media report speculates the number promoters of Salai Holdings to be abour 15,000 to 20,000 promoters investing to the tune of above 1000 crores of rupees.

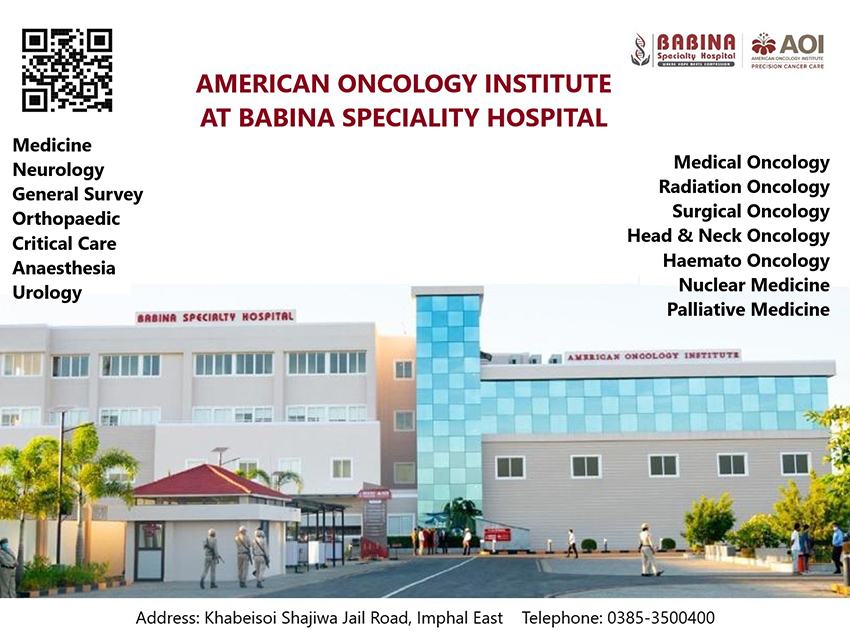

Till October 2019, all was well with the individual arrangements between the private company and the promoters, with the the promoters receiving their monthly 3 percent interest rate on their investment and Salai Holdings continuing to diversify to include a varying private limited enterprises like Salia Agri Consortium, Salai Agro Products, Salai Asia-Pacific Region Exim, Salai Bio Tech Park, Salai Constructions, Salai Consultancy, Salai Defence Technology, Salai Energy Solutions, Salai Engecors’s Lab. and even stepping into the retailing business in the form of Salai Mart. It was a time when Salai Holdings was being proclaimed by many intellectuals and even the chief minister of Manipur, N.Brien Singh, as a shining example of what private company could do in boosting the state’s economy.

All the images of a successful enterprise evaporated when the Founder-Dirctor of Salai Holding, Narengbam Samarjit suddenly had the shocking announcement on 29th October 2019 from London that an exile government of Manipur is formed, implying that Manipur is liberated. The government of Manipur immediately registered a police case of waging war against the State against the Salai Holdings’ Founder-Director and froze all of the company’s and its subsidiaries’ bank account, ordering an investigation.

Since November 2019 till date, it is standstill for the group of companies whose journey in setting up successful private enterprises were studied and even emulated in the state.

Even as the Board of Directors of the Salai Holding rusticated Samarjit from the list of the board of directors, following his controversial proclaimation, the National Intelligence Agency, NIA, which is investigating into Salai Holdings’s founder-director, Narengbam Samarjit’s case under the ambit of Terror financing/terror supporting, it is not showing any leniency to the private company in terms of lifting the freezing of its bank accounts, numbering 30 accounts, preventing the company from undertaking bulk transactions affecting its profitable retail operations.