Reading Manipur’s budget speech each year cannot but leave anyone with a concern for the future worried. What becomes evident each time is the unsustainability of the exercise, that is without liberal support from the Centre. The worst part of it is, rather than improve, this shortfall is going deeper with each passing year. Budget speech for this fiscal year 2022-2023 may be an indicator that recovery is not on the minds of the planners with a faith that liberal inflow of funds from the Centre will be perennial and this can be taken for granted.

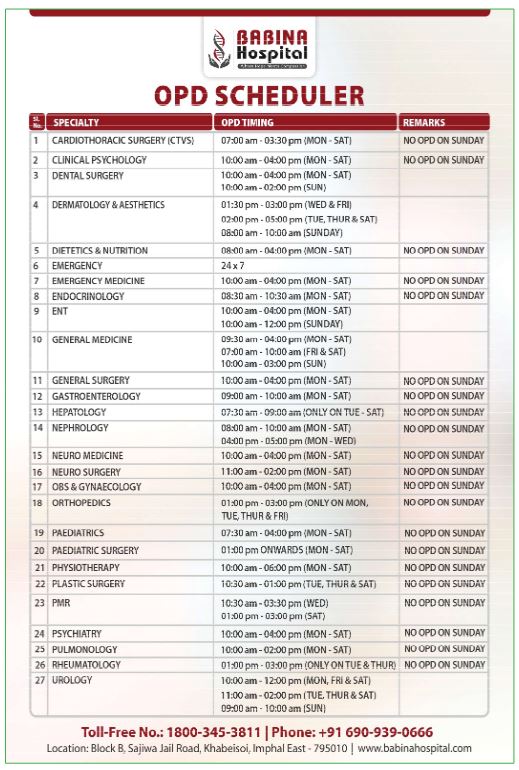

Budget estimate of Manipur for the fiscal year 2022-2023 presented on July 25, totals Rs. 34,930 crores. This is a whopping Rs. 6,106 crores more than the budget estimate of the last fiscal year 2021-2022. This is also anticipated to be a deficit budget after inflationary trends are factored in at the end of this fiscal year and a revised estimate is available. The fact is, of this Rs. 34,930 crores, the state’s own tax and non-tax receipts are merely Rs 2,400 crores and Rs 400 crores respectively. Even after taking into account the state’s share of central taxes, this gap is still too much, and therefore should be a cause for immense worry, not celebration.

No argument about it, the Centre has been a generous benefactor but there would have to be a time when the states are asked to be prepared to manage by a uniformed resource sharing norm between the Centre and states. This is why Manipur’s projected budget and its expenditure account must begin to reflect effort towards self-sufficiency in a more serious way.

It is true borrowings and loans are necessary devices for meeting budgetary needs in a modern economy, starting from individual families, to states, to nations. Hence, even deficit financing when expenditures are projected to shoot above available resources should be allowed so that the economy does not suffer damages or lose its capacity to regenerate, but provided this is to keep the economy confident and growing so that ultimately, when immediate shortages are overcome, debts can be serviced and cleared. When this is done, even if the economy still needs to borrow, lending agencies will be open to lend more, and the process can continue, benefiting both the borrower and lenders.

This is also why an economy living on borrowed money should be a little more frugal in its non-productive spendings especially in matters of welfare-ism. The tragic consequence of abandoning this caution is what the world is witnessing in the brutal and dramatic collapse of the Sri Lankan economy in recent times. The country had a generous lender in China. Nobody can say this financial liquidity made available to the country is bad, but what needed to be kept in mind is that the lender lends in the belief that there will be dividends when the loans get repaid. And if the lender is given the confidence that the borrower will repay, even while the original loan is not completely repaid, this lender would be willing to extend more loans. Even individuals who have availed bank loans would have no trouble understanding this cycle. But the moment the ender loses the confidence that the borrower is capable or repaying, or the borrower is not investing the borrowed money in enterprises which can grow and generate money enough to repay in the future, the lender can, and probably would, turn off the tap to end the fund flow.

This is precisely what happened to Sri Lanka. Analysts are now pointing out the factors behind the collapse of the country’s economy. There were some developments beyond the country’s control, in particular the COVID-19 crisis, which not only called for emergency health related spendings but also paralysed the economy for too long and beyond quick recovery. Over and above the emergency contingencies thrown up by the pandemic, the country is also accused of financial mismanagement, corruption and excessive welfare-ism far beyond its means. Conceding modern societies are marked by acute inequalities, welfare-ism is necessary, but this cannot be beyond the means of the state or nation to afford.

The Central government’s tax revenue is about Rs. 20 lakh crores a year. For instance, the tax revenue in the Union Budget for 2021-22 was estimated at Rs 22.17 lakh crores, but in the revised estimates it came down to Rs 19 lakh crores. Now that extreme COVID measures are over, this revenue is expected to grow in subsequent years. Of this, the share of the states from this Central receipt is about Rs. 5 lakh crores. The grants which come to states like Manipur are from these heads.

The moot point is, there could come a time, and most probably would, when other states begin to protest the subsidies to the poorer states when it is seen is at their cost, and Manipur must anticipate such a predicament. As a matter of fact, many analysts of the Khalistani movement in Punjab have pointed out it was somewhat related to such resource sharing. Unlike other insurgencies driven by a sense of deprivation, supporters of this movement, many of whom were in Canada and Britain, came to believe Punjab would be better off if it were to keep its resources without sharing.

Let me leave out a detail analysis of the Manipur Budget’s balance sheet. It is already a week since and many have already done their bits of number juggling. In any case, a chartered accountant can do a better job of this. While this close accounting is also necessary, what needs to be kept in mind is, the state budge is also about policy vision and how our leaders intend to actualise them. Otherwise, we might as well leave budget matters to accountants alone and even have accountants run the state.

It is not that this year’s Manipur Budget of Manipur Budget per say did not have vision element. It certainly did. Funds earmarked for investment in start-ups and other job generating enterprises, the focus on creating more model schools to improve education standard, the mention of attracting more external investment in areas of forest and water resources conservation etc., are some examples, but we would still contest that sharper focus on this area is necessary.

The budget also talks about mobilising its existing resource potential more efficiently. It mentions improved performance in the state’s own tax revenue collection drives in the area of state GST, motor vehicle tax, and sales tax. It also talks about expanding its tax base and reduce tax evasion. If the government is so serious about this, why was it also not talking about its neglected municipal water or land revenue collections. Hardly anybody clears these dues and the tax collectors do nothing about it either. If the government can afford to treat these as welfare measures, well and good, but budget paper itself is proof that it cannot. Once upon a time electric power revenue was in a similar situation, and after the introduction of prepaid meters, and some punitive measures introduced for power theft, we all know how much the situation has improved.

Then there is the question of leakages of public money because of official corruption. Despite all the official rhetoric, nobody will have any doubt corruption is still entrenched deep in the system. The nexus between contractors and the officialdom is there before everybody’s eyes in the multiplication of expensive Rs. 30 lakhs plus cars on our roads, and the reciprocal inequality in our society, pushing many below poverty line. Few welfare schemes like medical assistance for the poor are good to the extent of providing balm to inflammations, but other than winning votes, these cannot ever be the cure for the ill of poverty. For this, only a productive economy stimulated and nurtured by well-planned visionary state budgets are the answer.

A cursory comparison between two neighbouring countries, Vietnam and Cambodia, even from the vantage of a tourist should be illustrative. On Vietnam roads there are no profusion of expensive cars, though it is a much bigger and vibrant economy. Cross into Cambodia, the tourist will b surprised by the number of Toyota Lexus and Land Cruisers, but also alongside signs of poverty. The lesson is, Manipur must not measure its growth in terms of the number of high-end SUVs on its roads, but by its success in making a self-sufficient egalitarian society where all its citizens are empowered by quality education and professional skills.

Our plea is for the state leadership to begin the effort to make the state self-sufficient and capable of standing on its own legs without props from the Centre. It is the state’s good fortune that the Centre is generous in extending grants, but this condition must be taken as temporary by the state and therefore prepare and work towards an economic surplus future. Even if this is a big challenge and cannot be achieved overnight, the march towards such a future must begin now.