By Garrett Wood, Virginia Wesleyan University in Virginia Beach

While military drones remain important, the future may lie with consumer machines which outperform in terms of cost and performance.

With casualties on both sides running into the thousands and headlines reporting massive destruction, the war in Ukraine has demonstrated deadly advances in drone warfare that have surprised military experts and laypeople alike.

The often technical nature in which these advances are discussed masks an important but easily understood part of the drone war: non-military drones have played a critical role along the frontlines and in allowing rapid adaptation to enemy tactics and countermeasures.

High-end military drones remain important, but drones manufactured and sold commercially to everyday consumers outshine them on several margins.

Military drones such as Russia’s Shahed 136 cost around $US20,000 to $US50,000, while American drones such as the Reaper cost around $US30 million.

Turkey’s Bayraktar TB2, a wildly successful drone platform in the early days of the war which Ukrainians have written songs about, cost between $US2 and $US5 million per drone.

By contrast, commercial first-person view drones currently popular on both sides of the war tend to range in price from as little as $US300 to as much as $US2,000. They come with a camera that wirelessly transmits video feed to a controller’s goggles, headset, mobile device or another display.

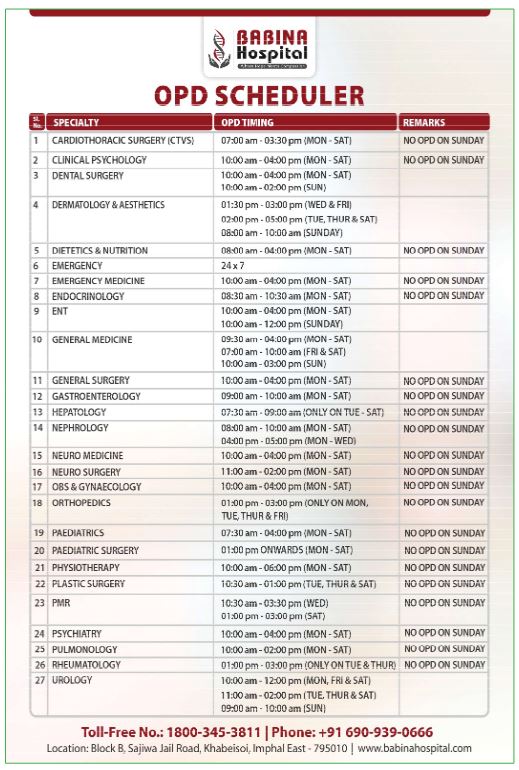

Surveillance missions

With some modifications, these consumer drones are just as capable of conducting military surveillance missions, adjusting the fire of friendly artillery and conducting strikes themselves with attached explosives.

That is, they perform the same roles as military drones but typically with less range or less sophisticated optics or some other decrease in performance characteristics.

Still, there have been periods of the war when up to two-thirds of Russian tanks were destroyed by commercial drones.

The fact that commercial drones are less capable in some ways than their military counterparts is the focus of some analysts. Their analysis of the relative capabilities of commercial and military drones is correct but also irrelevant.

The war in Ukraine features extensive air defence measures being employed by both sides, as well as extensive use of electronic warfare to down or disable drones.

These countermeasures are nearly as effective against specialised military drones as they are against modified commercial drones and drone losses can reach as high as 10,000 a month.

In this context, the marginal advantages military drones enjoy over commercial drones are often not worth their higher cost.

Numbers game

The advantage in the drone war over Ukraine goes to the side that can field more drones and since commercial drones are so much less expensive than military drones, it makes losing staggering amounts of them financially acceptable.

The commercial drone market presents armies with a large stock that is immediately available and offers a higher degree of variability. DJI, producer of the most popular commercial drones on the battlefield, offers 15 different types of drones and that is just one company.

Variety matters because different drones will be better suited to different missions, but also because greater variety means a greater likelihood of discovering a new niche to adapt to enemy tactics and countermeasures.

For instance, when traditional commercial drones began to be more consistently jammed by electronic warfare devices, first-person view drones were discovered to operate on a more difficult-to-jam connection and became far more popular among frontline soldiers.

Another solution to the jamming problem came in the form of commercially available mini-drones, often costing less than $US50, which could be flown into a battlefield to test the electronic warfare environment by acting as a “canary in the coal mine”.

The time it took to adapt to these problems was only the time it took for soldiers to purchase the drones and experiment with them.

Comparing this readily available and diverse commercial stock with typical military development and redesign timelines shows an underappreciated advantage to open adoption of deregulated drone markets.

Two different strategies

Ukraine and Russia have taken different approaches to these markets, and this has had predictable effects on their ability to conduct drone warfare.

Ukraine has enthusiastically embraced deregulation to encourage a maximum of commercial drone imports and has also lifted taxes on domestic drone producers.

As a result, Ukraine has led Russia in the use of modified commercial drones despite its comparatively small defence budget.

Russia, famous for suppressing even the most benign forms of opposition to the state and likely fearing the easy adoption of commercial drones by internal dissidents or terrorist organisations, has restricted access to commercial drones and has instead preferred to rely on specialised military drones.

This does not mean that Russia cannot produce more drones than Ukraine, and indeed Russia has enjoyed periods of advantage in the drone war over Ukraine.

However, relying on expensive military drones has sapped some of the advantages Russia enjoys in terms of having a much larger military budget because they are paying many times more than what they need to achieve and maintain large drone fleets.

The implications for other militaries, including advanced Western militaries, are straightforward. Modern and future warfare requires rapid adaptation and drone warfare in particular also requires volume.

The commercial drone market facilitates the pursuit of both.

There are tradeoffs in terms of not having a standardised drone fleet which will introduce complications in terms of logistics support and pilot training, but the results of Ukraine’s embrace of commercial drone markets speak for themselves.

Seeing the evolution of drone warfare in Ukraine, the United States began pushing what it calls the Replicator initiative in August last year.

This aims to develop thousands of attritable military drones across two years at a projected cost of $US1 billion. The difference between this approach and the commercial market approach is obvious.

Militarily useful drones are on the market now, while Replicator hopes to have them ready in two years. Replicator hopes to produce thousands of military drones, but if Replicator’s proposed budget was used to buy high-end commercial drones, it would be able to acquire hundreds of thousands of them.

Voters, military professionals, and policymakers need to seriously consider the advantages of a more open embrace of commercial drone markets for military purposes.

Garrett R. Wood is Assistant Professor of Management, Business, and Economics at the Virginia Wesleyan University, Virginia, United States.

Originally published under Creative Commons by 360info™.