[avatar user=”Nabakishore” size=”thumbnail” align=”left” link=”file” target=”_blank”]OINAM NABAKISHORE SINGH[/avatar]

Manipur has witnessed a large number of frauds by individuals and organizations from within the state and outside over the last decades. In spite of suffering heavy losses, people forget the past frauds and tend to believe new schemes launched with the primary objective of defrauding the gullible investors of their hard-earned or ill-acquired money. The most recent case in front of our eyes is the loss or likely loss of deposits and interest by all the investors of Salai(a non-banking financial entity of Salai Holdingd Pvt. Ltd. in Manipur) after its promoter left the country and declared independence of Manipur from London, and consequent actions by the law enforcing agencies.

The root cause of financial frauds can be looked at from three sources–smart individuals who read the mind of people well and use time-tested methods to dupe the gullible people, individuals with information technology knowledge committing cybercrimes to siphon off money from bank accounts, and poor knowledge of financial markets and carelessness.

Since the area of financial frauds is large, in this article we shall focus on general lack of basic financial literacy among common people of deposits and returns (read as cost of fund or interest). Just like in any other civilization, people in Manipur have used exotic means to hide cash by stuffing in mattresses, inserting in the thatch-eaves, etc. Recently, I heard from a known person that his neighbour, a trader in sandalwood/agar from Myanmar in good old 1970s hid huge of cash in gunny bags for a long time. Later, when the bags were opened, currency notes were found to have been spoilt by moisture and they became just pieces of paper without intrinsic values. Perhaps in good old days, before the existence of formal financial system and markets, hiding cash in mattresses was the wisest thing to prevent from losses due to theft, even though it was not fireproof. Now, we have banking financial services to meet some of our needs, if not all. However, for various reasons banks are either out of reach for common people or there is a mismatch between the expectations of the people and services provided by the banks.

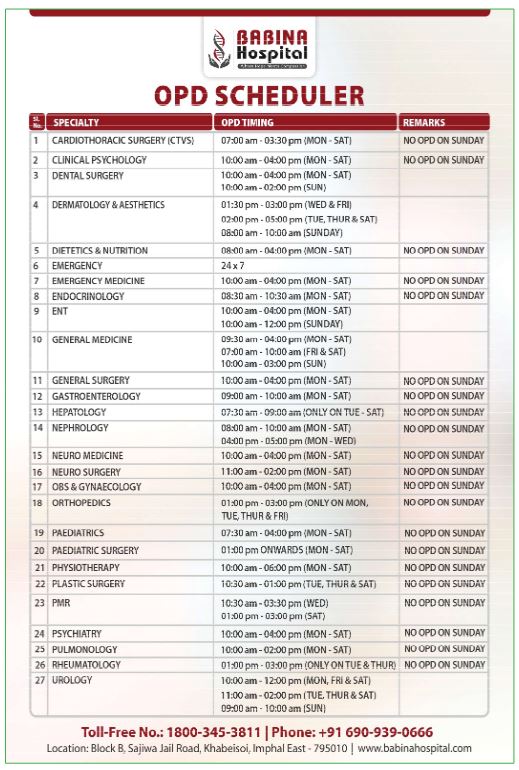

In Manipur, we have scheduled commercial banks both in public(government) and private sectors, cooperative banks and regional rural banks, which are regulated by the Reserve Bank of India under the Banking Regulation Act, 1949. State Bank of India, United Bank of India, Central Bank of India, Allahabad Bank, Bank of Baroda, Punjab National Bank, Punjab & Sindh Bank in Manipur are some of the public sector banks, whose majority equity is with the Government of India, while Axis Bank, ICICI Bank, HDFC Bank, Yes Bank, IndusInd Bank are some of the banks where private investors/promoters have more than 51 percent equity. It is quite natural to have more faith in public sector banks as they have the backing of the government. Recently, when the private sector bank, Yes Bank had troubles in meeting its obligations, the State Bank of India had to step in as per directions of the government to rescue it by injecting 49 percent equity in Yes Bank to keep it afloat/alive. Cooperative Banks are set up cooperative societies under the Cooperative Societies Act by shareholders, who are individuals, cooperative societies and government. They are regulated by both the Registrar of Cooperative Societies under Cooperative Societies Act and by RBI under Banking Regulation Act, 1949.

In Manipur, we have Manipur State Cooperative Bank, an apex cooperative bank, set up mainly to meet the agricultural credit needs of farmers, Imphal urban cooperative bank to cater to the credit needs of small and medium enterprises in urban areas and to provide banking services, Manipur Women’s Cooperative Bank set up mainly to look after the credit needs of women in micro and small business. The erstwhile Manipur Industrial Cooperative Bank, Manipur Land Development Bank and Manipur Mercantile Cooperative Banks have disappeared from the scene for various reasons like mismanagement. The Manipur Regional Rural Bank was setup, as in other states of India, with majority shares by the then Lead bank, United Bank of India and minority share by the State Government of Manipur. It mainly caters to the agricultural credits besides providing other banking services to Micro and Small Enterprises and customers.

Saving a part of income is the most primary human instinct as a contingent requirement of future needs and to earn reasonable returns, interest, on the saving. While saving by stuffing the cash in mattresses or iron chests may be good for reasons in good old time due to lack of banking services, hiding black money to avoid payment of income tax and hiding the source of ill-gotten income, on the other hand deposits in banks in saving bank accounts and term deposits (deposits for a fixed tenure with higher rate of interest) provide not only protection against theft and fire, but also assured returns/interest earnings, which may at least protect depositors against inflation. However, the rate of interest on bank deposits in the form of savings account and term deposits range from about 3.5 to 8 percent per annum.

It was reported that Salai offered 3% per month or 36% per annum interest on deposits with it. This huge difference on return from banks and that offered by Salai induced and tempted various sections of investors in Manipur–monthly Marups, pensioners with lump sum retirement benefits, individuals with disposable cash(legally or illegally earned) and honest investors–to part with their money to Salai in the hope of earning higher return. Nobody knew that Salai is not authorized to take deposits from anybody. In order to circumvent the restriction on taking deposits, Salai devised an innovative means–to sign an agreement with the investors spelling out the terms of lending and payment of interest. Instead of categorising the deposits as such, the cash received from the depositors, it was shown as lending to Salai to be repayable after one year lock-in-period at the monthly interest payment of 3%. The lock-in-period was an innovative condition allowing sufficient time to Salai to build up cash deposits from gullible public with attractive returns to have sufficient time and cash to discharge initial deposits. Things went on quite smoothly for quite some time without any disruption. Everybody was happy. Initial depositors shared the good news of high returns from Salai with friends and relatives of. Lo and behold, several people with extra cash rushed to Salai to take advantage of extremely high interest on his or her deposits. The most vulnerable and high amount depositors were the Marups–periodic collection of funds by members as a means to save cash to meet future needs of larger amount. Gradually, the corpus of deposits would have grown along with its liability.

Salai deposit collection scheme was an improved version of Ponzi and Pyramid Schemes, which have high chance of failure to discharge the obligations towards depositors. The depositors of Salai, perhaps, never pondered over the means of payment of 3% per month by Salai. They were quite happy to receive monthly payment of interest ignoring the activities engaged by Salai to generate the necessary revenue to repay their hard-earned money.Salai did started a few business–schools, retails shops, energy ventures, etc. It also opened a large number of sister companies in order to facilitate movement of funds.

To bolster the confidence of public in Salai, its promoter associated himself with a number of important authorities of the government in several programmes. There would be many photos where promoter is seen with Chief Minister and Ministers of Manipur. I too was invited once to cut the ribbon of opening a new office of Salai at Tera. I went there as requested by an Ex-MLA with the idea of encouraging local business. But, I saw a few computers in the new office. I thought the purpose of calling me to the function was to lend credibility to the organization. It also sponsored an expensive SUMO match during the Sangai Festival by flying in Japanese Sumo wrestlers from Japan. Some people from Czech Republic brought by Salai were seen in the media in connection with their purported programme of generating power from mini-hydro projects in the state. All such optics of associating with people from advanced countries and dignitaries of Manipur appeared to be well-planned strategy to instill confidence in unquestioning and reticent depositors/investors of Manipur.

While deposits in regulated financial institutions like scheduled commercial banks yield small returns, unregulated organization like Salai promise high interest with the risk of losing both principal and interest sooner than later. The public should probe and ponder over the returns promised. Had Salai engaged in business which gave returns more than 36% per annum, it would be feasible for it to discharge the debts of depositors. There are few business with such high return. In Manipur, only catering business may generate upto 50% returns. Grocery shops may give a return upto 24% with quick turnover as the margin is limited to 7-8%.

Deposits with banks are also not entirely free from risks. The depositors of Punjab & Maharashtra Cooperative Banks in Mumbai could not withdraw their deposits after the bank had liquidity problems as its loans to housing finance companies were defaulted. Similarly, Yes Bank depositors now cannot withdraw more than Rs. 50,000 per month although this restriction is likely to be lifted soon after SBI injected cash.

It is a good habit to keep our eyes and ears open to the financial news appearing in newspapers. It is also good to look up the meaning of financial terms appearing in newspapers by googling. Initially, it may appear difficult as financial jargons are used to explain the meaning of jargons. Wikipedia and Investopedia on the web will be helpful. Otherwise one may contact the relatives, friends and neighbours for their counsel before taking any financial decision. One should not be shy of asking of something new. Keep silent, remain stupid. Ask question, be informed. It is just like asking someone about a place or house on the street.

[avatar user=”Nabakishore” size=”thumbnail” align=”left” link=”file” target=”_blank”]OINAM NABAKISHORE SINGH[/avatar]