The Prime Minister, Narendra Modi, addressed the nation at 8.00 PM on the May 12 to announce a much-anticipated economic package to ignite the economy, which went into a slumber since the March 25 after an earlier decree by him. The address lasted 33 minutes and it was delivered in the most captivating oratory style characteristic of PM Modi. His words were full of positivity. He took great pride in India’s achievements and talents in various fields. He proudly said that the 21st Century belongs to India, which is actually an echo from several economists, who appreciate the advantages enjoyed by India now and likely growth of its economy. Export of hydroxychloroquine, a tablet to fight malaria, to the United States of America on request from the President of that country and Brazil for treatment of Covid-19 was cited as extraordinary achievement by this country in pharmaceutical industry. But then again, in the absence of malaria in the USA, it would not be necessary for drug firms in the country to make hydroxychloroquine so there is really nothing much to be really proud of exporting hydroxychloroquine. PM Modi also took another great pride in making two lakh personal protection equipment per day by indigenous companies at home as against nil production before the novel coronavirus began infecting people in this country. However, there is again little or no justification to brag about making PPE in India as it involves simple sewing of fabrics and plastics.

Prime Minister gave a clarion to the people of the nation to make the country Aatmanirbhar Bharat through Aatmanirbhar Abhiyan (Self-Reliant Movement). The philosophy of self-reliance has been one of the central approaches in Five Year Plans of the Central Government and State Governments (1974–1978), guided by the Planning Commission right after the independence of the country from the British. This fact along with other strategies are important approaches in the development efforts of India. In a special article by Suresh D Tendulkar, published in Economic & Political Weekly, Vol.9, Issue No.3,19 Jan, 1974, it is mentioned as heading of the article: “Planning for Growth, Redistribution and Self-Reliance in the Fifth Five-Year Plan”(Source: https://www.epw.in/journal/1974/3/special-articles/planning-growth-redistribution-and-self-reliance-fifth-five-year). The central theme of self-reliance implies that India should produce the goods and services required by it on its own. This also implies that India would be a closed economy where export and import would have to be closely regulated. A corollary of this approach is import substitution as the underlying objective of manufacture. When it was realized that restrictions on exports and imports was not helping India in its journey of economic growth, economic reforms were initiated in 1991 by dismantling import and export restrictions to a great extent. Import substitution was no longer emphasized in India’s economic growth strategy in the last thirty years. Rather importing goods-capital and raw material (including intermediate goods) to export became an important necessity for the growth of the economy. The present theme of making India Aatmanirbhar requires sounds as if the nation is going back to the Nehruvian economic strategy of import substitution and closed economy.

The Prime Minister in his address emphasized on five pillars of Aatmanirbhar Bharat–Economy, Infrastructure, System, Vibrant Demography and Demand. He hinted at the reforms of four L’s – land, labour, liquidity and law – for the growth of economy. His announcement on economic package of twenty lakh crore rupees was said to be 10 percent of India’s Gross Domestic Product(GDP). In fact, it is necessary to really probe the components of the package in order to understand their impact on the economy.

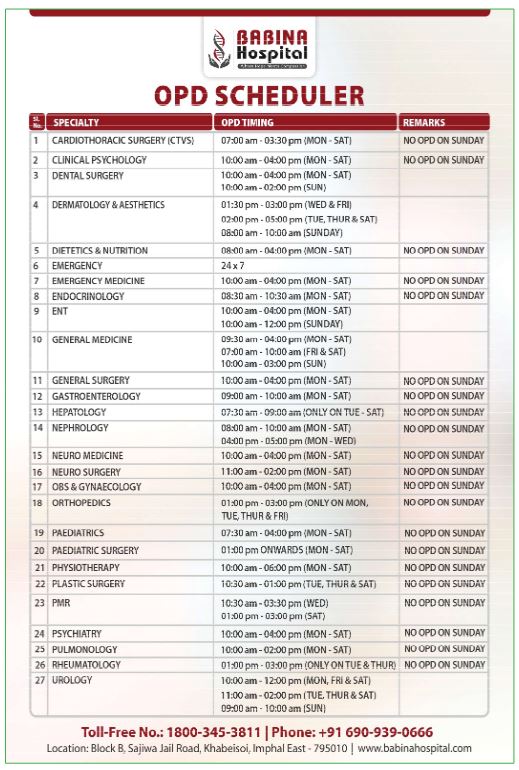

On the May 13, Union Finance Minister, Nirmala Sitharaman started giving details of economic package announced by the Prime Minister in a press conference. She narrated the main features of the relief and credit support to businesses, especially Micro, Small and Medium Enterprises(MSMEs) to support Indian Economy’s fight against Covid-19 (Source: https://pib.gov.in/PressReleasePage.aspx?PRID=1623601). A sum of Rs. 3 lakh crore was proposed to be given as term loan at a concessional rate of interest to meet need for additional emergency working capital to more than 45 lakh existing MSMEs by banks without guarantee and collateral subject to conditions – quantum of additional working capital is limited to 20 percent of the outstanding loan as on February 29, the accounts of the unit is standard (loans taken by the units are not yet classified as NPA in the book of the banks), outstanding loan and turnover of the unit shall be up to Rs.25 crores and below Rs.100 crores respectively. The Government of India will guarantee the new loans. What is the cost to the Government of India in this package of credit of Rs.3 lakh crore? The answer is very little. At the most, it will have to pay guarantee cost to the MSME units, which are already having standard account (No NPA as on date). Existing creditors, by and large, shall be on their own and may be willing to extend additional credit up to 20 percent of the outstanding loan in their own business interest. Further, such instructions from the government dilute the independence of the management of banks. Banks should be taking decisions on credit without any pressure from any quarter. Are the private sector banks under any obligation to obey the instructions of government to extend credit to business?

For the MSMEs which are having problems of NPAs with banks, the government will provide a sum of Rs.4000 crore as premium to cover the risk of default on behalf of the MSMEs to the Credit Guarantee Trust Fund for Micro and Small Enterprises so that banks are comfortable in extending a subordinate debt to promoters of such MSMEs equal to 15 percent of their existing stake in the unit subject to Rs.75 lakhs. Total assistance under this initiative amounts to Rs. 20,000 crores to about 2 lakh MSMEs. The Government also proposes to spend a sum of Rs.1000 crore to create a corpus and leverage it to raise Rs.40,000 crores from investors to have a total sum of Rs.50,000 as Fund of Fund to infuse equity capital in MSMEs. These proposals, if implemented, will give a boost to the capital structure of MSMEs and make them more credit worthy for additional credit.

Merging of services and manufacturing in the definition of MSME is a desirable step. Raising the limit of investment and turnover in the new definition of MSMEs will help them in enjoying the incentives of MSME better. Proposal to release the receivables of MSMEs from the Central Government and Central Public Sector Undertakings within 45 days of announcement on May 13, will infuse the much-needed liquidity to the MSMEs. Promotion of e-marketplace for MSMEs is a good step if implemented with handholding and guidance. Many MSMEs may not have the wherewithal of using e-marketplace to compete in tenders for procurement by the government and its undertakings. Restricting global tenders up to Rs.200 crores announced by the government shall help in promoting local procurement.

The above-mentioned measures and assistance are to help the MSMEs to resume their businesses as soon as relaxations are available during the lockdown. However, there remains many questions which are to be answered to achieve the envisaged goals. Now, most of the migrant labours have left the places of work and returned to their homes. Since a large proportion of the workforce in MSMEs are migrant labours, it will be quite difficult to resume businesses including services without them. A large number of boys and girls from Manipur work in shopping malls, hotels, restaurants, Call centres, IT enabled service providers. It was reported that more 150 Manipuri nurses have come back from Kolkata after finding the working environment to be unsafe and leaving many hospitals without vital nursing staff. Similarly, a number of workers engaged in the textile industries in Surat in Gujarat and Bhiwandi (Powerloom) in Maharashtra have left for home. Will the migrant labourers come back to their earlier place of work?.

While there could be production of goods and services upto 50 percent of the capacity, another uncertainty is the volume of demand, which has got a mention in the speech of Prime Minister. Very little has been done by the government to boost demand in the economy. This question takes us to the need for transfer of money by the government directly to the hand of the poor people. There is a demand from well-known economists and opposition parties to transfer money to the hands of poor people to confer purchasing power to them. Much needs to be done by the government of India as other governments of USA, Japan, etc., have done by invoking fiscal instruments rather than monetary policy tools.